Over the last two weeks, the 30-year fixed-rate mortgage dropped by half a percent, as concerns about a potential recession continue to loom.

KEY TAKEAWAYS

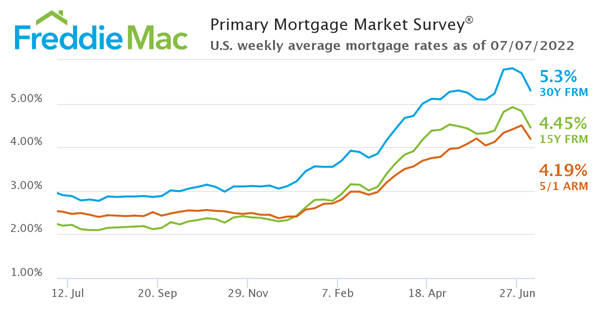

15-year fixed-rate mortgages averaged 4.45% with an average 0.8 point, down from 4.83% last week.

14.9% of listings nationwide had their prices reduced last month, the highest rate since before the pandemic.

Freddie Mac released its Primary Mortgage Market Survey this morning, showing that the 30-year fixed-rate mortgage (FRM) averaged 5.3%, a significant change from last week’s 5.7%.

A year ago at this time, the 30-year FRM averaged 2.9%.

“Over the last two weeks, the 30-year, fixed-rate mortgage dropped by half a percent, as concerns about a potential recession continue to rise,” said Sam Khater, Freddie Mac’s chief economist. “While the drop provides minor relief to buyers, the housing market will continue to normalize if home-price growth materially slows due to the combination of low housing affordability and an expected economic slowdown.”

15-year FRMs averaged 4.45% with an average 0.8 point, down from last week when it averaged 4.83%. A year ago at this time, the 15-year FRM averaged 2.2%.

“The Freddie Mac fixed rate for a 30-year loan took a sharp drop this week, falling to 5.3% and offsetting some of the significant rate increases of May and June amid rising recession concerns,” said Realtor.com Senior Economic Research Analyst Joel Berner. “The 40-basis-point fall from last week comes on the heels of the recent volatility in the 10-year Treasury yield, which dropped below 2.8% in the first week of July and rebounded to 2.9% Wednesday after spending most of June above 3%.

Berner said that, in June, active listings increased by 18.7% over last year, the largest annual growth in Realtor.com data history. With more homes on the market, sellers are forced to compete on prices; 14.9% of listings nationwide had their price reduced last month, the highest rate since before the pandemic began.

While the drop provides some relief to buyers, Freddie Mac predicts the housing market will normalize as long as home-price growth slows, due to the combination of low housing affordability and an expected economic slowdown.

Source: National Mortgage Professional

I’d love your feedback and questions!

If you enjoyed today’s post please “like and share” this page so someone else can benefit from it!

For the best rates and fees, work with me personally.